Less than a year after President Obama restored commercial air travel between the U.S. and Cuba, airlines are cutting back on what looked to be promising routes. Some have speculated that airlines may have jumped the gun in the capacity they planned to deliver to the market, as we have very rarely seen a market grow as quickly as this. Others believe that some reduction was inevitable in such a new and explosive market. Let’s look at the story the data tells.

Before the announcement was made in December of 2014 that Obama was working to improve relations with Cuba, only 24,268 bookings were made between the U.S. and Cuba on scheduled air services that year. Considering there were no direct routes, over 75 percent of passengers started or ended their journeys at Miami International Airport, but were routed through the Bahamas or the Cayman Islands to reach Cuba.

While interest in travel to Cuba remains high among many Americans, the once hopeful outlook of restored relations – and air travel – between the countries isn’t looking as bright.

The demand that stopped demanding

Though regular passenger service between the U.S. and Cuba formally reopened in November 2016, there was alternate air service available prior to the announcement. Before December, passengers relied on established charter operations, like PublicServiceCharters.com, and an American Airlines route to Holguín to get to Cuba. The table below shows the rise in available seat capacity from November to December of last year, as many airlines waited for the holiday season to introduce the new routes.

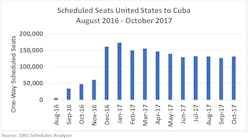

In December 2016, budget and mainline carriers alike jumped on the available daily routes between the U.S. and Cuba, as Southwest, Delta, Spirit, Frontier and JetBlue all either added or expanded service to Cuba within a month. Almost overnight, air travel capacity went from 60,390 one-way seats to 160,648.

From August to December of last year, airlines offering scheduled service to Cuba jumped from five to ten, with routes suddenly available across 22 city pairs compared to the five city pairs available just three months earlier. This scale of growth has rarely been experienced elsewhere, and while some may say it speaks to the high level of demand for the market, there are already signs that the demand won’t hold.

Making a route successful

Since the market opened, airlines have expectedly cut back on scheduled capacity, now averaging about 135,000 one-way seats per month, down roughly 20 percent from the peak in January. Even with the decrease, seat capacity is consistently remaining four times what it was from the September 2016 level when American Airlines launched its first scheduled services to Cuba.

Looking at the data is easy, but when a market has been closed for over 50 years, preemptively judging the possible demand for a destination is no simple task. In some cases, an educated guess might be the best bet. When airlines are looking to add a new route, factors they might consider include:

- Capital cities: When airlines are looking to expand their networks, many first look to capital cities as connectivity is usually a given.

- Major ethnic flows: Airlines take into consideration popular destinations from a certain country. For example, an airline might add more scheduled services between two city pairs where the demand is high and offer less frequent services from a different departure city but same arrival city. In the case of U.S.-Cuba direct air service, relaxed travel restrictions and visa entry policies can also be a major factor.

- Leisure markets: Airlines will also look to add service to potential leisure markets based on similar, established markets. The availability of varying accommodation levels is also quite important for those markets with a high proportion of inbound leisurely-type travelers and rates to meet the degrees of hospitality. Airlines will factor in econometric data, such as the levels of GDP, and more importantly, disposable income, to be used as travel market foresight.

- Network size: Mainline and budget airlines both add services to build their networks, sometimes testing the water before taking the plunge. Historic stimulation rates also play an important role as airlines will look at how other new markets that have been opened have responded to the opening of direct services rather than indirect routings.

- Sector length: As crazy as it may seem, airlines consider the sector length versus market opportunity when looking to expand. A Florida-Cuba sector would probably be no more than an hour and fifteen minutes; a sector to the Southern Caribbean would be two and a half hours, so an airline would perhaps prefer to run two roundtrips than one longer sector.

With the rise of the low-cost carriers, travelers are more willing to travel to destinations they might not have previously considered – for the right price, of course. Thus, when airlines, especially budget operators, add new flights, it generates interest and curiosity among travelers. This is a strategy many airlines use to create demand for underserved markets and provide an outlet for additional routes to airlines who are looking to expand and add more services.

What’s working, and what’s got to go

Even as recent as a few months ago, while some airlines were looking to pull out on some of their routes to Cuba, others were prepared on the sidelines, waiting to snatch them up. Most recently, it seems like many of the airlines offering regular services to Cuba are looking to opt out on at least a few routes, if not all together, including Southwest, American JetBlue and Frontier.

According to the numbers, there were 1,456 flights scheduled between October through December of last year, whereas there are only 1,275 for this summer. As major carriers are pulling out, smaller city pairs are taking a noticeable hit. This is a classic thing when new markets open. Airlines “test” the market and will over time retrench back to the major city pairs. Sometimes they will leave that city pair completely, and other times they will reduce weekly frequency or in some cases merely run seasonal services. Over time, some of those routes may actually grow back to the initial levels. Though not up-to-date compared to U.S. standards, the international airport in Havana is still the most equipped to handle the capacity of incoming flights and passengers from the U.S., and thus remains the most popular arrival destination for travelers and airlines.

Policy impacts and what they mean for Cuba

While current policy changes threaten to undo years of work, there is also an underlying fragility to the U.S.-Cuban travel market and taking this away seems contrary to America’s sense of pioneering. U.S. airlines have invested considerably in both capacity and marketing to advertise their services. Would the government want to risk upsetting the market with a complete policy overhaul? Should travel policies to Cuba be reversed, airlines could stand to lose millions of dollars, and the direct and indirect impacts felt would be widespread.

Not only would airlines be losing out on revenue, but a greater economic impact might be felt by the local Cuban chain as jobs could be stripped. But just because the U.S.-Cuban market may be at risk doesn’t mean other markets are. Interest in Cuba as a leisure destination, especially when other popular travel markets are facing threats like terrorism, from Canada and Europe continues to grow. Compared to the 116,106 one-way seats flown from Europe to Cuba in July 2016, bookings were up over 25 percent for July of this year, with 145,211 one-way seats to Cuba departing Europe. Of those bookings, travel from France and the UK has risen over 60 percent and 44 percent, respectively, in July 2017 when compared to data from the same month the previous year.

Looking ahead

Before, one could have made an argument either way as to the existence of a travel market to Cuba for Americans. Now, there is no doubt that the interest and curiosity among travelers exists. While some policy reversals have made it once again more difficult to travel to Cuba, Americans now have the desire to go. Since there is capacity available, travelers will find other ways to get to Cuba if direct air service is no longer available.

Even if more U.S. airlines continue to reduce routes to Cuba, the country will not be left in the dust. Looking from a global scale, the aviation industry is seeing continued interest from the European Union and Canada in Cuba as a tourist destination.

Never have so many aviation industry experts seen a market expand so rapidly – seemingly overnight – as U.S. to Cuba air service. The world is getting smaller, people want to travel and airlines want to and can help facilitate this. Pulling the plug now would be very difficult and may prove to be more trouble than its worth.

One of the most respected aviation experts in the industry, John’s analysis have been featured in major publications including The New York Times, CNN, USA Today, BBC, the Financial Times, TIME and more. John captures and analyzes complex aviation data and industry trends to provide commentary on what’s driving changes in the travel market. He’s served as a featured speaker at major industry events including the CAPA Americas Aviation Summit, the CAPA World Aviation Summit, the Routesonline Strategy Summit and more. John is a senior analyst and executive vice president at aviation data provider OAG, a partner at MIDAS aviation, and owner of JG Aviation Consultants, Ltd. At OAG, John manages and works to enhance OAG’s product portfolio and new product development.