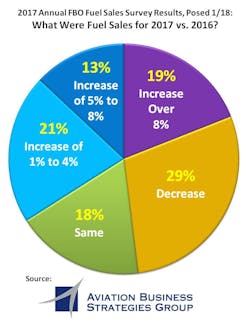

53% of FBOs Report Increased Fuel Sales in 2017 with 73% Giving the Economy a Thumbs Up

Results of Aviation Business Strategies Group's (ABSG) Annual FBO Fuel Sales Survey indicates that 53 percent of FBOs in the U.S. experienced increased fuel sales in 2017 compared to 2016 with 73 percent of survey respondents giving a favorable rating to the economy.

In addition, nearly half of the FBOs responding to the survey indicated they added to their workforce in 2017 and plan to continue hiring for newly created positions in 2018, according to ABSGs Principals John Enticknap and Ron Jackson.

"Overall, we saw improvement in just about every category in 2017 compared to 2016 with 34 percent reporting an increase in fuel sales of 1 percent to 8 percent." Enticknap said. "Although 29 percent of FBOs reporting showed a decrease in fuel sales, the top 19 percent performers, with increased fuels sales of more than 8 percent, held their own. In fact, several that we talked to reported back-to-back months of record fuel sales."

Jackson added that fuel sales were bouyed by an increase in hours flown by the business aircraft fleet. "Flight data provided by ARGUS TRAQPak shows that flight activity in 2017 eclipsed 3 million flight hours for the first time since 2008. With Part 135 operators leading the way, 2017 flight activity rose 3.9 percent from 2016 while flight hours rose 5.5 percent for the same period," Jackson said.

Another element of the survey also tries to gage confidence in the economy by asking FBOs if they think the economy is headed in the right direction. "We were encouraged to see that 73 percent gave the economy a strong thumbs up," Enticknap said. "By comparison, in last year's survey, 53 percent approved the direction of the economy and the year before, only 27 percent gave approval."

New to this year's survey, ABSG sought to find out if FBOs were expanding their workforce by creating new jobs.

"Nearly half the FBOs that responded said they had either added to their workforce in 2017 or were planning to hire at least one additional employee in 2018," explained Jackson. "This not only shows increased economic confidence, it also helps verify leading market indicators that point to at least a mild business aviation market recovery."

FBO Industry Forecast

Based on the their Annual FBO Fuel Sales Survey, interviews with FBO owners and aircraft operators, and analysis of the oil markets and the aviation fuel industry, Enticknap and Jackson have put together the following forecast for the FBO industry in 2018:

- As part their FBO annual fuel survey, ABSG also asks FBOs to forecast fuel sales for 2018 compared to their 2017 results. Here are their predictions:

- 34 percent said they expect to have at least the same fuel sales as in 2017

- 50 percent said they forecast fuel sales increases of 1 percent to 8 percent

- 9 percent expect to have fuels sales exceed 8 percent

- Only 7 percent expect fuel sales to decline

- The FBO industry will continue a moderate recovery from the 2008-09 downturn. This renewal will spawn new job creations at the FBO level as facilities concentrate on providing a greater customer service experience.

- FBO industry consolidation will continue to be dormant among the bigger chains, however, new FBO networks are emerging with target acquisitions that include second tier FBO locations.

- As the economy expands in 2018, business aviation flight hours will continue to increase at a steady pace of between 2% to 4% monthly throughout the year resulting in increased FBO fuel sales.

- In the oil field, stronger than expected demand will push prices upwards in the first half of 2018. Brent crude, currently hovering around $65 per barrel, will gradually increase to between $75 to $80 per barrel and then settle down to an average of $70 through the end of the year.

- Regarding Jet A fuel costs, Gulf Coast Platts current price is approximately $1.97 per gallon and will follow the price of oil, as in the past. With the continued upward pressure on crude, we would anticipate Gulf Coast prices to increase to approximately $2.25 per gallon by the last quarter of 2018.

- FBO operators will continue to enhance their brand by increasing their investments in customer service training and improvements to their internal safety culture.

- The industry will continue to embrace stronger safety programs as aircraft operators seek to partner with FBOs who have in place, at a minimum, a safety management system (SMS) and/or preferably, an IS-BAH registration designation.