Annual FBO Fuel Sales Survey Results and 2022 Industry Forecast

April 4, 2022, NBAA S&D Conference, San Diego, CA —Results of Aviation Business Strategies Group's (ABSG) Annual FBO Fuel Sales Survey indicates that 72% of FBOs in the U.S. and Canada had increased fuel sales during 2021 vs. 2020.

According to ABSGs principals John Enticknap and Ron Jackson, the overall survey results showed a dramatic turnaround for most of the FBO industry following a depressed 2020 when the Covid-19 pandemic crippled fuel sales.

"After the Covid induced recession of 2020, there appears to be a very rapid recovery in fuel sales for most FBOs responding to our survey,” Enticknap said. "If fact, many FBOs are reporting fuel sales equal to, if not greater than, pre-pandemic levels recorded in 2019.”

Enticknap said that a record number of FBOs, nearly 40% of those responding, reported an increase in fuel sales of more than 8%.

However, according to Jackson, the apparent robust recovery was not felt by every FBO in the industry.

“Of the FBOs reporting, 16% said they had a decrease in fuel sales in 2021 compared to 2020 while 13% indicated about the same fuel sales,” Jackson said. “Some FBOs that rely on Avgas sales to help buoy their bottom line reported they are having a hard time making ends meet. They site a depressed flight training market, scarce fuel availability and disrupted fuel deliveries by truck.”

According to ABSG, confidence in the economy again suffered a waning blow during 2021 as 50% of the survey respondents said the economy is headed in the wrong direction with only 17% providing a positive response while 33% were undecided.

“The trend is similar to the results of last year’s survey when 42% of respondents were negative about the direction of the economy while 18% were positive with 40% undecided,” Enticknap said.

A follow-on question from the 2021 survey asked FBOs whether they would be offering Sustainable Alternative Fuel (SAF) to their customers during 2022. The results were about the same as 2021 with 80% of respondents indicating they would not be offering SAF with only 1% signaling they would while 20% were undecided.

According the Jackson, a comment made by one of the survey respondents seemed to summarize the sentiment offered by others regarding tendering SAF: “Offering SAF to our customers would be great. However, there is a lack of supply and the cost of transportation from a limited amount of suppliers is almost prohibitive. We don’t expect SAF to be sufficiently available in our area for at least the next three to five years.”

Top 5 FBO Industry Concerns

Another area the ABSG survey explores with FBO operators involves feedback regarding their concerns and greatest challenges facing the industry. An open-ended question resulted in these top five concerns:

- Inflation and higher fuel prices affecting a consistent and sustained flow of aircraft traffic on the ramp.

- Ability to hire and keep employees and the associated costs of training a seemingly transient workforce.

- Higher costs of doing business including increased insurance costs as well as employee wages and benefits.

- More government regulations, rising airport fees and increased taxes.

- Covid concerns and the geopolitical landscape causing supply chain disruptions resulting in a shortage of parts and supplies.

2021 FBO Industry Forecast: Challenging Times Ahead

Based on their Annual FBO Fuel Sales Survey, interviews with FBO owners and aircraft operators, analysis of the oil markets and the aviation fuel industry, Enticknap and Jackson have put together the following forecast for the FBO industry in 2022. In a nutshell, there are challenging times ahead.

FBO Operators Indicate Optimistic Fuel Sales for 2022

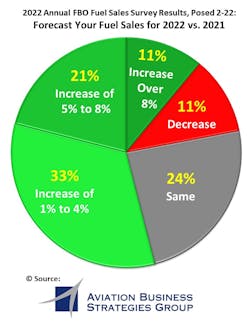

FBO operators responding to the survey remain optimistic for continued strong fuel sales through 2022 with 64% indicating an increase. We asked FBO operators to predict fuel sales for 2022 vs. 2021 with the following results.

- 25% said they expect to have at least the same fuel sales as in 2021

- 33% said they forecast fuel sales increases of 1% to 4%

- 21% said they forecast fuel sales increases of 5% to 8%

- 10% expect to have fuels sales exceed 8%

- 11% expect fuel sales to decline

Expect Oil and Jet A Fuel Prices to Continue to Spike and Retreat

The effects of geopolitical discord, international conflict and higher inflationary pressures have provided a backdrop of economic uncertainty regarding aviation fuel prices for the rest of 2022. This will result in a very rocky road ahead as upward price pressure continues on crude oil with WTI repeatedly pushing through the $100 per barrel threshold and spiking to as much as $130 per barrel before retreating. Until the war in Ukraine is settled and a realistic global view on oil demand is established, expect a continued up and down pricing cycle with occasional wild swings.

As a result, Jet A fuel prices will be irregular for most of the year and will generally follow the price of oil as in the past. FBOs will need to be mindful of what is in their inventory and adjust their fuel margins regularly.

As of this writing, the National Average for Jet A is nearly $6 per gallon with 100 LL selling roughly 15 cents per gallon higher.

Higher Inflation

As we progress through 2022, there is growing evidence that the rate of higher inflation is not transitory and will be with us for a while. Economic pressures such as rising wages and benefits, higher costs of consumer goods and services, higher prices for housing and sustained high energy costs should result in a steady increase in the Federal Reserve raising interest rates, at a minimum of 25 basis points, several times in 2022. Some forecasts call for at least seven rate hikes through March 2023 and the possibility of multiple hikes of 50 basis points.

FBOs looking to finance any capital improvements should look to lock in lower interest rates sooner rather than later.

Leveling Off of Business Aircraft Flight Hours

Since business aircraft flight hours started to rebound early last year from the dismal covid induced recession of 2020, there has been a steady increase in month-to-month flight activity as reported by TRAQPak from ARGUS. At some point, this flight activity should start to flatten out to approximate levels registered in pre-covid days of 2019.

Another factor that could hinder or slow flight activity is the spiraling high cost of aviation fuel. Because most corporate flight departments operate on yearly budget forecasts, higher fuel prices can possibly put a squeeze on these budgets and start to limit the amount of flight hours scheduled and/or logged.

FBO Industry Movements and Consolidations

A steady pace of FBO industry investments, movements and consolidations continued in 2021 with the private investment equity firm KKR purchasing Atlantic Aviation. Atlantic, in turn, purchased the Lynx Aviation network and, under a separate agreement, combined the Ross Aviation FBO locations into their network. Most recently, Signature Flight Support has reportedly entered into an agreement to purchase the FBO holdings of TAC Air’s 16 locations. This will add to Signature’s FBO footprint of more than 200 FBO locations worldwide.

In addition, some smaller and emerging chains continue to add FBOs sporadically through the acquisition process.

Trend: FBO Selection Based on Safety and Health Standards

In the present and post Covid-19 environment, aircraft operators, particularly those flying internationally, will become more selective in choosing FBO service providers in favor of those with a minimum of at least a safety management system (SMS) and/or an IS-BAH registration designation. This is due in part to perceived health and safety measures in place. During the height of the Covid pandemic, many FBOs put in place standard operating procedures to deal with present and future global health concerns.