During the final months of 2022, Ground Support Worldwide surveyed members of the industry, gathering firsthand feedback on various issues as they apply to ground support equipment (GSE) and ground handling personnel. More than 100 professionals contributed to the survey. Their input is reflected in following pages as we examine the overall status of our industry.

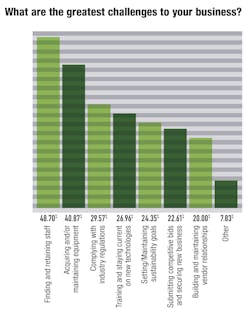

Like in 2022, both finding and retaining staff as well as acquiring and maintaining equipment remained the top two challenges. However, those two issues swapped positions in our poll as nearly 50 percent of survey respondents identified staffing issues as a challenge for the industry.

“Everything we do basically revolves around labor. It makes a lot of sense that it’s No. 1 on people’s minds,” says Rodrigo Yepes, Regional CEO, North and Central America at Grupo EULEN.

“It was probably a very, very critical issue I would say in Q4 of 2021 and the first half of 2022 because that’s where the volume ramped up again back to pre-COVID levels, and we felt the strain,” he adds. “I think it’s still a very critical issue because even though many companies, like ourselves, have stabilized and have already achieved those pre-pandemic levels – both revenue wise and staffing wise. However, we did have to do a lot of things to get back to those levels and to stabilize our recruitment pipeline and getting people in the door.”

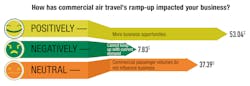

The increase in commercial airline traffic has created more business opportunities for more than half of those surveyed.

Acquiring and maintaining equipment also remains a challenge to businesses, leading to strains on company budgets. Approximately two-thirds of the industry personnel surveyed noted supply chain bottlenecks have had an impact on their business.

“Every industry, and the whole economy, went through that supply chain strain,” Yepes says.

However, he adds, ground handling has unique challenges. Yepes notes that retail businesses may have a broad spectrum of vendors and suppliers. But for ground handlers, that number of vendors is much lower.

Staffing levels in the industry are rising. While last year, 34 percent of respondents had increased staff, this year’s survey showed nearly half of our respondents had increased their staff. Along with that trend, the number of companies that decreased staff went from 32 percent to approximately 22 percent.

“I’m actually a little bit surprised that ‘increased’ was only 50 percent,” Yepes says. “If we follow just the overall aviation trends, from the airlines, the bulk of the recovery in the industry was the first semester of 2022. I would say that’s when everything spiked.”

The spike in hiring is reflected in our survey as 30 percent of survey participants indicated they hired 50 or more employees in the last year.

“Everyone was looking to hire larger numbers than before. The airlines are also looking into hiring. Working at airports, you need the security badges at different levels of clearance,” Yepes says. “It’s a prized commodity to find an employee with a badge, and everyone is going after them.”

Some companies may have been overstaffed throughout 2021 as several government incentives to retain employees and payroll were available. It is possible that the 29 percent of companies that kept staffing level fit into this category. Yepes notes that with pre-pandemic levels being achieved by many across the industry, this future growth may level off.

Given the nature of the ground support industry, safety remains a top priority for those surveyed.

More than 80 percent of respondents have a safety management system (SMS) in place. An SMS is required for ground service providers to achieve IATA Safety Audit of Ground Operations (ISAGO) registration and for FBOs to earn International Standard for Business Aircraft Handling (IS-BAH) certification.

“It’s going to become evermore present, if it already isn’t, in every airport for you to have some sort of certification to be able to operate based on an overall SMS,” Yepes says.

There appears to be a strong correlation between SMS adoption and workplace safety as approximately 90 percent of those surveyed reported 10 or fewer workplace accidents in the past year.

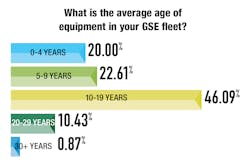

New ground support equipment is entering the market, as this year’s survey saw a slight rise in equipment aged 0-4 years and a slight decrease in equipment older than 20 years. But the vast majority of equipment is between 5 and 19 years old, which is similar to the results of the 2022 State of the Industry survey.

However, we could see more equipment purchases in 2023 as nearly 90 percent of those surveyed indicated their budget would increase or remain the same this year – more than half indicated their budgets will increase.

It is possible that improved supply chain conditions could increase the amount of new GSE in the field this year. As supply chain bottlenecks had an increasingly larger effect on the industry, some GSE customers utilized the secondary market and deployed more used GSE into operations.

More than 80 percent of those surveyed are using diesel powered GSE in their operations – 27 percent of which are using exclusively diesel-powered equipment.

This number seems to indicate that the industry’s larger trend to electrify GSE will require time to take effect.

However, 13 percent of our survey’s respondents stated their GSE fleets were comprised of a majority of electric ground support equipment. Another 3.48 percent stated their fleets are comprised entirely of electric GSE.

At the end of 2022, IATA called on the industry to adopt the use of enhanced GSE. The association reasoned increased technology, like anti-collision solutions, can improve safety and mitigate costs associated with ground damage.

“Transitioning to enhanced GSE with anti-collision technology is a no-brainer. We have proven technology that can improve safety. And with the cost of ground damage growing across the industry there is a clear business case supporting early adoption. The challenge now is to put together a roadmap so that all stakeholders are aligned on a transition plan,” Nick Careen, IATA senior vice president operations, safety and security, said in a release that announced the association’s call for enhanced GSE.

Of those we surveyed, 30 percent indicated they currently use GSE equipped with anti-collision technology.

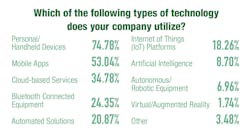

Adoption of technology solutions continues to grow in the industry. However the range of technology currently in use varies greatly based on our survey results.

Hesitancy to adopt new technology boils down to time and money. More than 60 percent of those surveyed indicated the cost of equipment most deterred them from adopting new tech. Cost of training, time for training and complexity of training also factored into these decisions.

“The financial piece does play a lot into the equation because most of the technology that’s available out there for ground handling companies is relatively new. Because it’s relatively new, it’s still more expensive than what you have for other industries,” Yepes says.

“In an industry that’s, in general, very labor intensive and labor costs are very expensive, then when you add in that other component, it might drive you up,” he adds. “In general, it’s very good practice to implement them.”

The industry may not be fully recovered from the impacts of the COVID-19 pandemic. But the growth across all of aviation indicates many of the pandemic’s effects are waning.

IATA reported that total traffic in November of 2022 rose 41.3 percent compared to November figures from 2021. What’s more, the association reported global traffic was at 75.3 percent of levels from November 2019.

“A very general trend that’s going to come is, let’s label it, stability,” Yepes says. “The numbers that we saw in late 2021 and 2022, passenger continuing to fly everywhere any time, there’s really no off-season.

“I think the aviation industry is going to pull through whatever comes the next few months and continue to grow,” he continues. “We’re going to have to be there to accompany that growth.”