Pressure Rises on Bonds

D.J. Mehigan, a senior vice president with the investment banking firm Morgan Keegan, expects short-term interest rates to rise in the near term as airports continue to seek new ways to finance infrastructure historically guaranteed by the air carriers, while long-term rates are less predictable. In this environment, Mehigan agrees with those who are calling for repeal or reform of the alternative minimum tax (AMT), now under Congressional consideration (sidebar).

"Airlines and airports have diverged in their financial strength," observes Mehigan. "It used to be that airlines had good credit strength and airports were going along with them. Things have really changed.

"If you look at the credit ratings for airlines, they're much lower - a lot of them in the B range and even the CCC range. Airports have always been in the A range, some AA."

In light of the economies of airports and airlines, he says, airports are pushing for tax reform that will open up more general airport revenue bonds to tax-free status or similar relief, which today is being led by the call for reform or repeal of the alternative minimum tax. At the same time, says Mehigan, airports are looking at other options, including tapping more private sector funds.

"I think what's important is forming a partnership," he says. "There are ways to do that with financial sharing mechanisms, joint ventures, private-public partnerships.

"There are some new airports being developed with [private] developer teams."

Despite the uncertain tax environment, Mehigan says airports are not on hold in terms of bond issuance and refunding. "This stuff has been brought up for years, but it seems to have momentum now.

"What we try to do is work around the AMT penalty. There are finance techniques that allow you to do that, and that's what airports frequently are doing. One mechanism is the use of variable rate debt versus fixed rate debt, particularly with some parts of the interest rate curve. Variable rate debt comes with a much lower AMT penalty. Some airports aren't comfortable with the variable rate debt, or maybe they have too much of it in their debt profile already."

A Refunding Environment

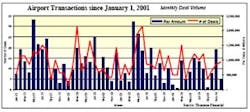

Mehigan explains that the attractiveness of interest rates in recent years has led to many airports refunding, or refinancing, existing bonds. "Low interest rates drive the refundings," he says. "Airports have been on top of that fairly well. There are issues that come up because the curve is flattening quite a bit - short-term interest rates are quickly rising and the long-term rates appear to be rising more slowly than people had anticipated. That's unusual; they typically both rise. In fact, long-term rates have declined this year.

"I would expect short-term rates to continue to rise for awhile; it's more difficult to predict long-term rates. I think they're bound to rise as well. You have to look at the past, and we're still well below average for short-term and long-term rates."

Other Alternatives

Mehigan reinforces his assertion that the U.S. airport sector will need to increase its focus on private sector investment in their public facilities as the airlines become less and less a party to guaranteeing long-term debt. He points to the new Terminal 4 at JFK International, which is essentially a build-operate-transfer endeavor using private monies for construction and startup.

"The airlines are going to get killed if the capacity issue is not met at airports," says Mehigan. "As an airport guy, that's what is most important to me, capacity. And capacity for airports just means having enough infrastructure; for the airlines it means seats.

"I'm not telling you that terminals should be privately financed or airports should be privatized, but it's a way to go for some to fill the separation between where airports and airlines are going. Developers have capital."

Mehigan says larger airports like Atlanta and San Francisco are using sophisticated financing structures such as a forward starting swap, which he says is akin to futures trading. "They're looking at future debt and trying to lock in some rates today, using the municipal derivative curve. When you do that you lock into today's rates and it provides you a hedge against rising interest rates. Several airports are doing this; Raleigh-Durham and the Washington, D.C. airports just did it. It's a way to take on risk, yet lower your cost of capital."

Several airports have multiple lien structures. "Multiple liens can be a great way to do things because you separate the risk and the security structure," he says. "We're working on a deal in which we'll have a separate lien backed by the rental car transaction tax."

AMT Reform

The Morgan Keegan airport banker agrees with those, including airport lobbying groups, who are calling for the repeal or modification of the alternative minimum tax. "It would have a large effect," he predicts. "Interest earned from private activity bonds is subject to this alternative minimum tax. Airports, as well as health care and a couple of other sectors, quite a bit of their debt is subject to the AMT. What that does is it brings much higher costs; it's really a penalty, and the AMT was not put in place for that purpose.

"In Congress there have been at least two bills to basically repeal the AMT, to increase the level of the individual exemption. I think most in this industry think that it will not happen, a full repeal. It would be a big boon for airports."

The primary reason AMT reform may not occur, says Mehigan is the obvious loss of specific tax revenue. "The argument from someone on the tax committee is we're going to lose some revenue," he says. "I think in the long run a repeal is going to work itself out because you'll get investor demand, and that means more bonds which means more interest paid, which is more taxes."